A runup in U.S. Treasury yields sapped demand for danger belongings. Earnings for firms within the index had fallen for 2 straight quarters by way of June.

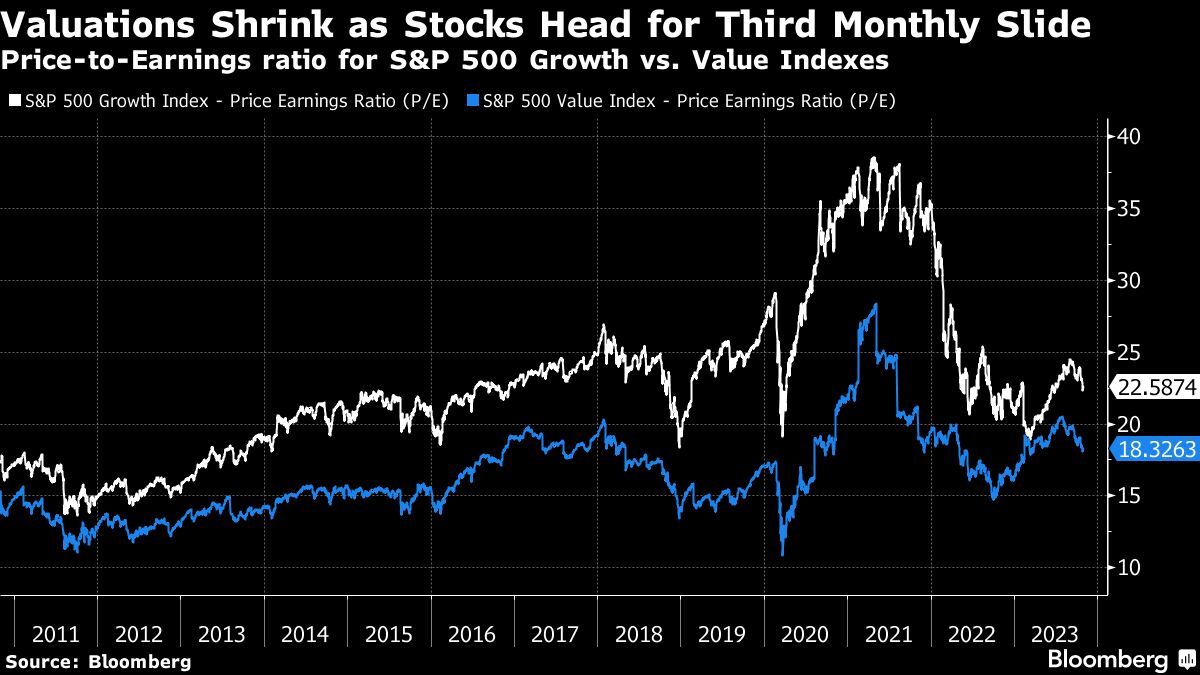

Whereas the massive firms have all the time had the next valuation a number of, the hole between them and the remainder of the market has grown an excessive amount of, Kelly mentioned.

“I’d relatively underweight mega caps, obese worth and and simply permit inflation to come back down,” he mentioned. Inside sectors, he prefers power and financials.

JPM’s name on inflation is that it’ll come all the way down to 2% by the fourth quarter of 2024. If it doesn’t damages the financial system considerably, a few of these least expensive sectors can do higher, mentioned Kelly.

As for small caps, Kelly mentioned he’s “nonetheless nervous” as a result of nearly half of firms within the Russell 2000 Index “aren’t really making a revenue.”

The index is buying and selling close to a stage final seen in October 2020, it’s 10% under its long term 200-day shifting common and 75% of the Russell 2000 constituents are already in bear markets.

It’s too early to get to small caps with the specter of recession looming over the financial system. “I’d relatively get in after we’ve seen a specific amount of financial disruption,” he mentioned.