Using AI to difficulty insurance coverage coverage quotes generates combined emotions amongst customers, with the proportion who’re comfy with the know-how akin to the quantity who are usually not. Insurers face the problem of convincing customers to belief AI to deal with duties resembling quoting, regardless of some scepticism. Swiss Re’s introduction of the Swiss Re Life Information Scout, a generative AI-powered underwriting device, exemplifies the business’s dedication to leveraging AI for improved underwriting processes.

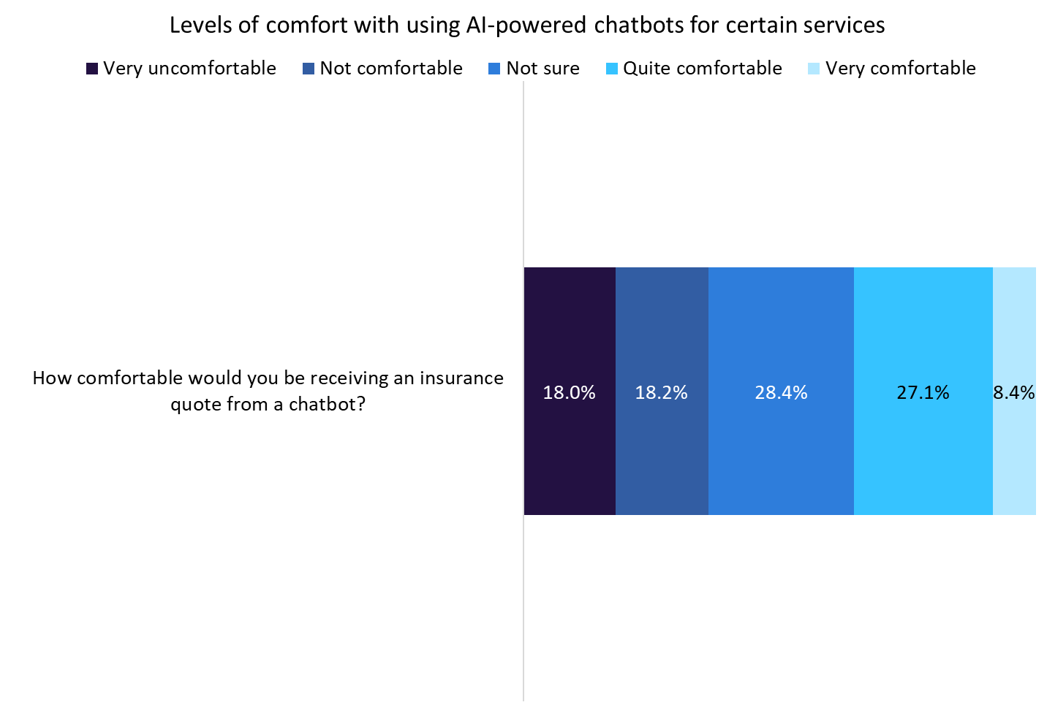

GlobalData’s 2023 UK Insurance coverage Shopper Survey sheds mild on client attitudes in the direction of AI-powered options in insurance coverage. The information reveals that 35.5% of customers are comfy receiving a quote from an AI-powered chatbot, in comparison with 36.2% who are usually not. This highlights the necessity for insurers to construct belief and supply optimistic experiences to sway the opinions of those that are hesitant about AI know-how. By demonstrating the advantages and reliability of AI-driven underwriting instruments, insurers can bridge the hole in client confidence and drive the adoption of those modern options.

Swiss Re’s Life Information Scout, powered by generative AI and the Microsoft Azure OpenAI Service, goals to streamline the underwriting course of by offering AI-generated responses to skilled queries, enabling sooner and extra correct threat evaluation. This device is focused at life insurance coverage, the place onboarding is usually sluggish. The device goals to reinforce decision-making by permitting underwriters to entry data and obtain AI-generated responses sooner, in flip rushing up the onboarding course of.

Whereas customers don’t immediately work together with the AI device, the underlying know-how could elevate considerations amongst some people concerning the transparency and equity of the quoting course of. Insurers should prioritise constructing client confidence in AI-driven options by emphasising the advantages, accuracy, and moral use of AI in underwriting. Because the business evolves, there could also be alternatives to develop extra consumer-facing AI processes that tackle these considerations immediately, making certain a smoother transition to widespread AI adoption in insurance coverage. Confidence and transparency are key components in bridging the hole between client scepticism and the advantages of AI know-how within the insurance coverage worth chain.

As insurers proceed to develop AI-powered options for underwriting and different areas of the insurance coverage worth chain, the potential functions of this know-how are huge. From expediting threat evaluation to enhancing data switch, AI affords important advantages for insurers and customers alike. Nonetheless, constructing belief amongst customers stays a vital facet of AI adoption. By showcasing the worth and reliability of AI-driven instruments just like the Swiss Re Life Information Scout, insurers can navigate the hole in client confidence and drive widespread acceptance of AI know-how within the insurance coverage sector.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

resolution for what you are promoting, so we provide a free pattern you can obtain by

submitting the under type

By GlobalData