What You Have to Know

- Nvidia led features, whereas Apple was named a prime decide for 2024 by Financial institution of America on optimism over its upcoming outcomes.

- The stakes are excessive for America’s techn behemoths to start out delivering on AI guarantees with their earnings poised to decelerate, BofA says.

- Huge tech corporations are operating out of steam as their earnings momentum faces a calm down, in accordance with UBS.

Shares rebounded after a $2 trillion selloff, with Company America kicking off the busiest week for first-quarter earnings that shall be key in shaping the outlook for equities.

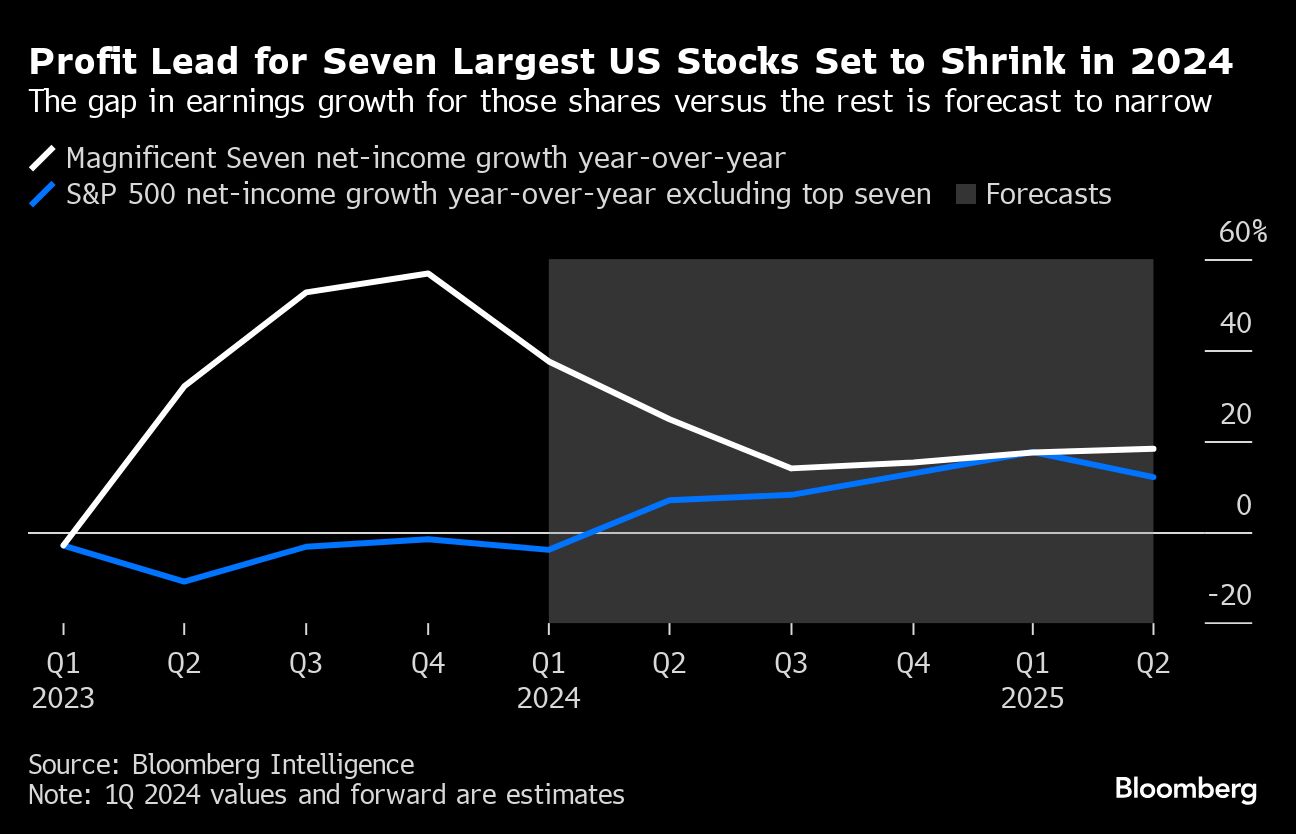

About 180 S&P 500 corporations — greater than 40% of the index’s market capitalization — are as a consequence of report their outcomes this week. However the greatest expectations are for the “Magnificent Seven” megacaps, whose income are forecast to rise practically 40% from a 12 months in the past, in accordance with Bloomberg Intelligence.

The concentrate on earnings comes after a selloff triggered by geopolitical jitters and indicators the Federal Reserve shall be in no rush to chop charges.

“Simply beating consensus estimates for earnings received’t be sufficient this time round,” mentioned Matt Maley at Miller Tabak + Co. “We’re going to need to see a lot better steering from Company America if the inventory market goes to renew its advance.”

Fairness strategists at Wall Avenue’s prime banks are cut up on whether or not corporations can ship on strong earnings forecasts.

Whereas Morgan Stanley’s Michael Wilson mentioned he expects revenue development to enhance because the economic system strengthens, his counterpart at JPMorgan Chase & Co., Mislav Matejka, argues that sizzling inflation, a stronger greenback and geopolitical tensions are clouding the outlook.

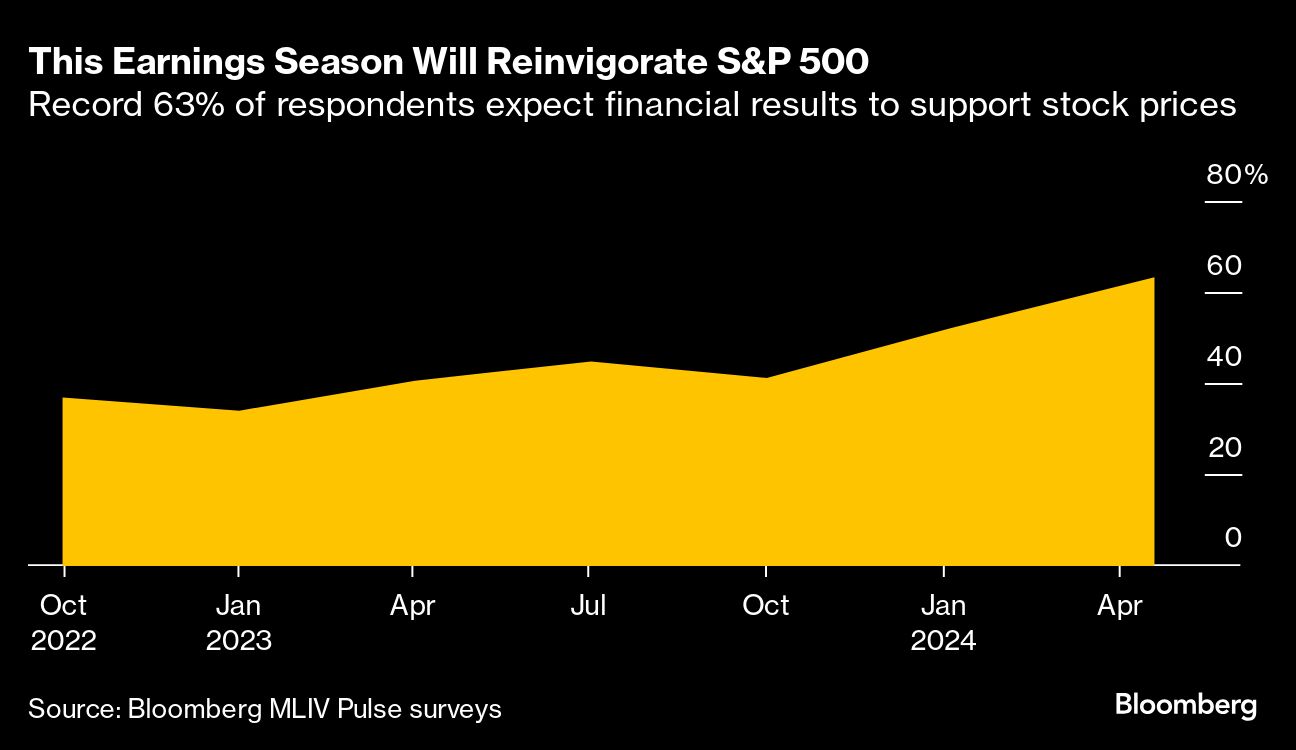

Almost two-thirds of 409 respondents in Bloomberg’s Markets Stay Pulse survey mentioned they anticipate earnings to present the U.S. fairness benchmark a lift. That’s the very best vote of confidence for company income for the reason that ballot started asking the query in October 2022.

The S&P 500 reclaimed its 5,000 mark — following a six-day rout. Nvidia Corp. led features in massive tech. Apple Inc. was named a prime decide for 2024 at Financial institution of America Corp. on optimism over the iPhone maker’s upcoming outcomes. The UK’s FTSE 100 Index hit a document excessive.

Treasuries wavered forward of a flurry of bond auctions that can check buyers’ urge for food after yields hit the very best in 2024.

Hedge funds are getting again to purchasing world equities, shrugging off broader market volatility to gobble up tech shares on the quickest tempo in two months, in accordance with Goldman Sachs Group Inc.’s buying and selling desk.

New lengthy positions outpaced brief gross sales final week whereas single shares noticed “the biggest notional shopping for in over a 12 months,” the merchants wrote in a word, marking a bullish flip in sentiment after hedge funds had been promoting for the prior three weeks.

And U.S. earnings updates this week shall be key to see if they will hold buoying threat urge for food in a higher-for-longer charge surroundings, in accordance with the BlackRock Funding Institute’s weekly commentary. “We’re obese US shares and see the AI theme broadening,” BII famous.

“Issues about rising rates of interest, cussed inflation, and geopolitical dangers aren’t going anyplace — however this week, the tech sector could also be calling the photographs,” mentioned Chris Larkin at E*Commerce from Morgan Stanley.

The stakes are excessive for America’s know-how behemoths to start out delivering on synthetic intelligence guarantees with their earnings poised to decelerate, in accordance with Financial institution of America Corp. strategists.